30+ process of getting a mortgage

Identify the right mortgage. Preapproval is the process of learning how much a lender is willing to lend to you.

Realtor S Lets Collab Josh Bartlett Loan Originator

Finding the right one and getting your offer accepted.

. Get pre-approved for a loan 3. Youll want to have items such as your pay stubs W2s Social Security or pension award letter bank statements and possibly your Federal Tax Returns 1040s available. Decide on your mortgage term.

Web A mortgage refinance is the process of getting a new home loan to replace an existing one. The first step we recommend any home buyer take is to get a mortgage preapproval. During processing the Mortgage Consultant.

DTI requirements can vary by lender and loan type but generally speaking the lower your monthly debt compared to your income the better. The first steps in getting a mortgage are to work out what kind of mortgage is best for you. Apply Once you feel youre ready to go from looking to buying its time to apply.

Web Deductions for property taxes are limited to 10000 which limits deductions for many residents in higher-tax states. Apply for a Mortgage. Before you set off to get a mortgage make sure youre financially prepared for.

The one thats best for you will depend. A longer loan term generally gives you lower monthly payments. Web You need to know how to get a mortgage if youre not buying a house with cash.

Now that youve found the home you want to buy and a lender to work with the mortgage process begins. Web This document includes a price a suggested closing time frame typically 30 to 90 days from the accepted offer and conditions that allow you to cancel or renegotiate the contract. Web The Mortgage Process Would-be borrowers begin the process by applying to one or more mortgage lenders.

Signed home purchase contract which confirms that youre under. Strengthen your credit A robust credit score in the 700s preferably demonstrates to mortgage lenders that you can responsibly manage your debt. When you apply for a preapproval lenders take a look at your income assets and credit and tell you how much they can lend you.

These are the main steps involved in the process. Web 6 steps to apply for and get a mortgage Once youve laid the groundwork you can apply for the mortgage. Web In addition to actually getting approved for your mortgage there is another step to consider in your timeline if youre buying a home.

Web How to Get a Mortgage 1. Low down payment options and competitive rates are just some of the advantages of SoFi Home Mortgage Loans. Before checking out whats on the market you should be confident that you know how much a lender will loan you.

A shorter loan term means youll pay less in. Web How to get a mortgage step by step Step 1. Web Youll need supporting documents to verify everything so you may want to prepare your mortgage application documents in advance to help expedite the application process.

How much home can you afford. The lender will ask for evidence that the borrower is capable of repaying the loan. A 30-year fixed-rate loan is the most popular choice for the lowest monthly payment.

There are several steps youll need to take to become a homeowner so heres a rundown of what you need to do. Choose a mortgage lender 5. Web If you need lower monthly payments a 30-year mortgage may be the better move.

Find a home and make an offer 4. Web Most homebuyers get a 15- or 30-year mortgage but some lenders offer other terms. Get a mortgage preapproval before you house hunt.

Homeowners typically refinance for three reasons. Apply For Mortgage Preapproval. Web Submit your application.

Web Your step-by-step guide to the mortgage process 1. Here are some items you may want to have handy. Give yourself a financial checkup.

Web 1 day agoFor example if rates drop your lender might allow you to re-lock at the lower rate if you pay a float-down fee. And lending products to help you through the mortgage process. Web The mortgage loan process is straightforward if you have a regular job adequate income and a good credit score.

Gather the Documents Needed for. Interest on up to 750000 of mortgage debt can be deducted by new homebuyers. During the mortgage pre-approval process your lender will also look at your debt-to-income ratio DTI which compares your monthly debt obligations to your monthly income.

You also might have to pay a fee to extend your rate lock if your loan closes late. SoFi offers fixed-rate mortgages with terms of 10 15 20 and 30 years. These nine steps can help you get a mortgage the right way.

Web Make sure you have everything in order before you apply for a mortgage. Complete a full mortgage application 6. Recent pay stub s W-2 or 1099 forms.

At the end of 15 years youd pay 334620164700 less than a 30. Web Step 1. Once a lender has an idea of your income credit score and available funds they can come back and give you an idea of what youre actually going to be approved for Prequalification vs.

Theyll also determine your interest rate. Most people start looking for properties long before they are pre-approved for a mortgage and. Choose the right type of.

Web Mortgage application is submitted to processing The Mortgage Consultant collects and verifies all documents necessary to prepare the loan file for underwriting. At this stage your lender will have you fill out a full application and ask you to supply documentation relating to your income debts and assets. The stress-free guide to getting a mortgage.

These documents provide us with everything that we need to know about you the borrower and the property you are financing. There are many types of house loans available. Order a home inspection 7.

Web The first step to get a mortgage is to talk to a loan officer and get approved Helali says. Order a home inspection. Web 9 Steps To Getting A Mortgage.

Once you start the mortgage process youll discover how much lenders love documentation. Have the home appraised 8. Every month youd pay 1859.

Web If you lengthen the term to 30 years the monthly payment reduces by about a third but you also tack on an extra 77451 in interest over the life of the loan. Web Mortgage Process Explained 1. Schedule a home inspection as soon as you can.

Get Preapproved Or Be Ready To Show Proof Of Funds. The idea behind a preapproval is simple. Find your rate in minutes.

Things I Would Never Do After Being In The Mortgage Industry 30 Year Tiktok

Bizbox Mortgage Linkedin

10 Simple Steps To Purchase A Home Pennymac

The Ultimate Mortgage Guidebook Homewise

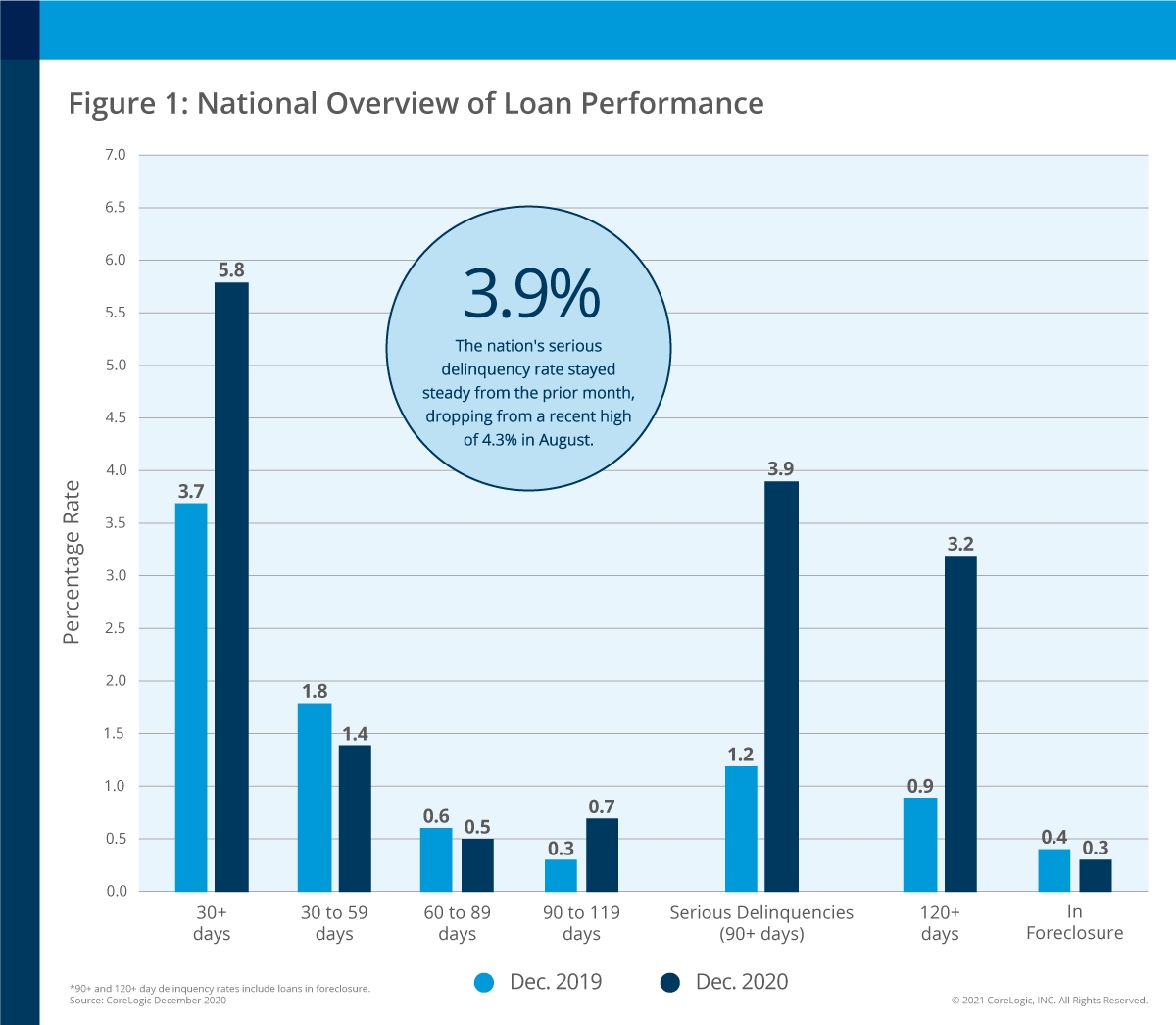

A Look Back Us Mortgage Delinquency Rates Experience Record Highs And Lows In 2020 Corelogic Reports Business Wire

Ask Me About Va Loan Josh Bartlett Loan Originator

Getting A Mortgage 6 Ways To Make Process Easy

![]()

Homewise Review Loans Canada

Borrowers Save Chip Jewell Mortgage Loan Officer

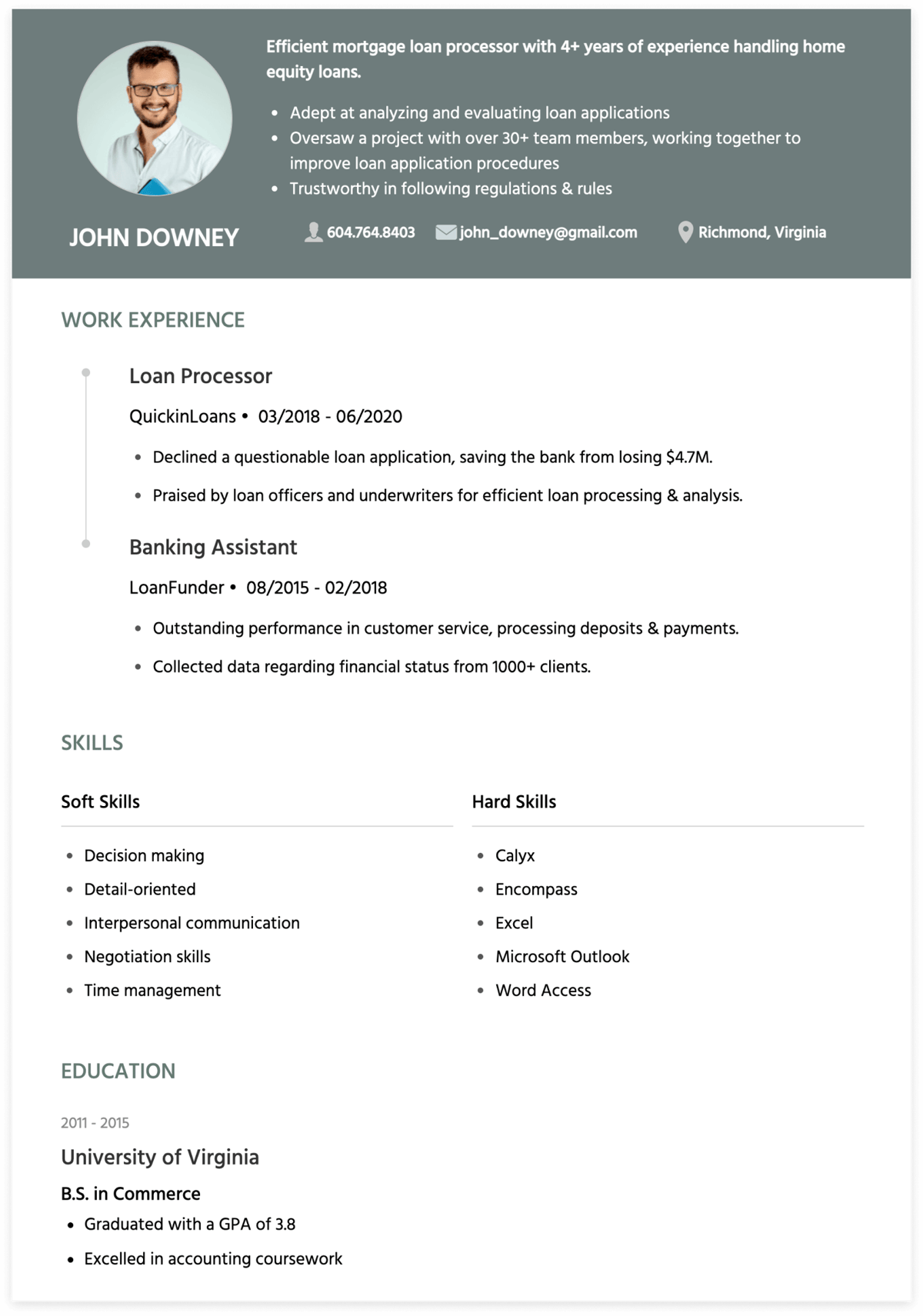

Loan Processor Resume W Samples Cakeresume

How To Get A Mortgage A Step By Step Guide Rocket Mortgage

Sinking Under Your Mortgage Farm

Investment Home Loan 30 Lenders Commercial Point Finance

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Free Financial Family Home Safety Advice For Homeowners

Better Launches One Day Mortgage To Revolutionize Home Buying Experience For Americans

Refinance Process Mortgage Blog